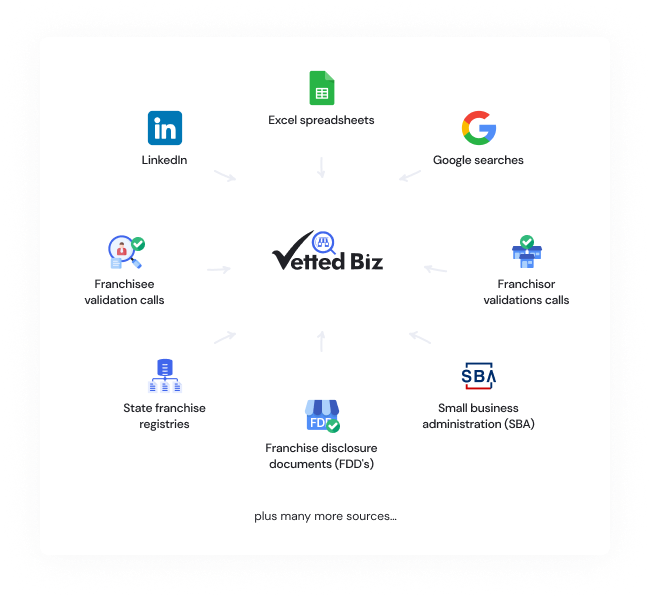

Make better decisions with better data

Use the largest, most up-to-date, and accessible franchise database to empower your sales, purchasing, and investment decisions within the franchise industry.

Trusted by some of the biggest names in franchising

Finding the right franchise data to inform your decision making shouldn’t be this complicated.

Let us save you time and money by gathering all of the actionable data you need in one place.

“I get the information I want in one easy place. Worth every penny."

I use Vetted Biz for a number of reasons. As a franchisor, I want to see how we're viewed and how our competition is performing. As a franchisee, I want to see how our Franchisor system is doing.

As someone that is always looking for opportunities and curious to learn more, it's the most comprehensive database and, perhaps even more importantly, the data is presented in an organized and easy to assimilate format.”

Guy Coffey

Co-Founder of Frenchies Franchise, Franchise Owner, and Podcast Host

Lack of comprehensive, up-to-date franchise data can leave you in the dark and at a disadvantage.

See how our easy-to-use franchise database can save you both time and money.

DATA HIGHLIGHTS

Unbiased franchise data to tell you what you need to know

See below examples of the types of data we have for each franchise profile:

Gross sales

Franchise investment cost

Franchisor financials

Earnings

Growth rate

Franchisor contacts

Resale value

Failure rate

Franchisee contacts

Franchise payback period

Financial performance disclosures

SBA loan eligibility

Industry and category benchmarking

Franchise-specific content

And more!

“Vetted Biz is an excellent resource for researching franchise data, news, and business resources. They are true professionals. They are smart, resourceful and the data is clean. They have been a pleasure to work with.”

Sabrina Wall

CEO, Senior Franchise Broker, Franchisee, Entrepreneur

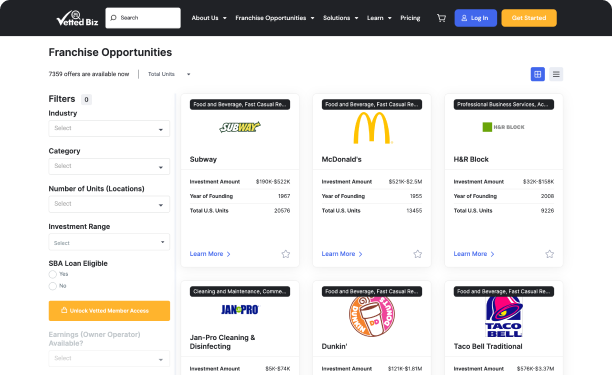

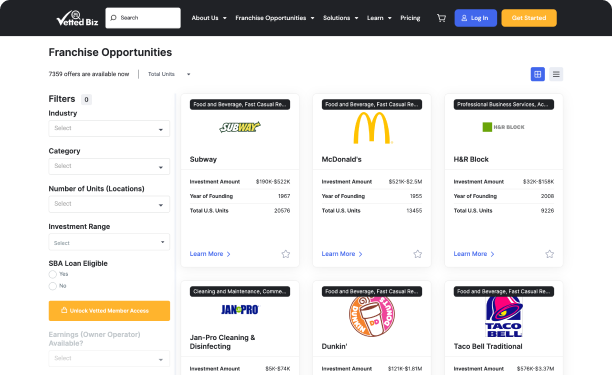

FILTER AND SEARCH

Stop wasting time searching for franchise information on search engines or out-of-date websites

Easily sort and filter franchises using our advanced filtering tool. Below are some of the fields you can sort by:

Industry

Earnings

Category

Gross sales

Investment range

Number of units (locations)

“Vetted Biz is the best place on the internet to find up-to-date information on franchises. The leadership is forward thinking and constantly innovating its products to keep users informed.”

Jason Revere

Franchise Consultant

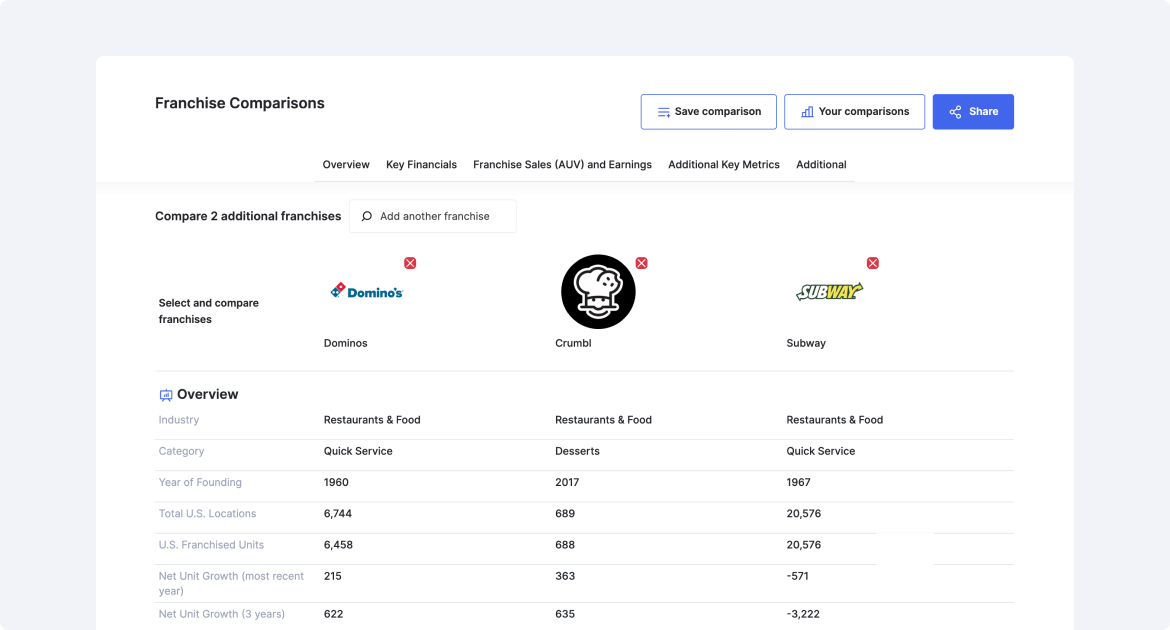

COMPARE FRANCHISES

Quickly compare franchises side by side using our franchise comparison tool

FRANCHISE SUPPLIERS

Have a service or offering to sell to franchisors or franchisees? Find new prospects.

Discover qualified prospects in seconds with Vetted Biz's all-in-one prospecting tool. Find hundreds of thousands of franchise industry contacts in our ever-evolving contact database.

Franchisee contact information

7,654

Franchise brands in our contact database

343,867

First and last names

73,641

Emails

50,215

LinkedIn’s

337,801

Phone numbers

Franchisor contact information

7,654

Franchise brands in our contact database

9,930

Management team first and last names

4,463

LinkedIn’s